Anatomy of political risk

Quantifying the economic impact of risks emanating from the political system (e.g., referendum in the United Kingdom to leave the European Union, shutdown of the federal government in the United States) has often proven difficult due to a lack of firm-level data on exposure to political risk and on the political issues firms are most concerned about.

-

prof. dr. Stephan Hollander

Full Professor

TiSEM: Tilburg School of Economics and Management

View full profile

TiSEM: Department AccountancyS.Hollander@tilburguniversity.edu Room K 204

In the paper “Firm-Level Political Risk: Measurement and Effects,” recently published in the Quarterly Journal of Economics, we adapt a simple pattern-based sequence classification method developed in computational linguistics to construct firm-level measures of the extent and type of political risk faced by firms listed in the United States. Specifically, we measure the share of conservations in earnings conference calls devoted to political risks, including, for example, concerns about regulation (e.g., Trump’s tax reform), ballot initiatives, and government funding.

Earnings calls

Conference calls held in conjunction with an earnings release—in short, “earnings calls”—begin with a presentation by management, during which corporate executives (e.g., CEO, CFO) provide their interpretation of the firm’s performance during the quarter, followed by a question-and-answer (Q&A) session with market participants (usually, but not limited to, financial analysts). A typical earnings call lasts about 46 minutes, with an average of 18 minutes for the presentation and 28 minutes for the Q&A.

For our baseline measure, we use a training library of political text (an undergraduate political science textbook, articles from the political section of major U.S. newspapers) and a training library of non-political text (because managers mainly talk about their firms’ operating and financial performance in earnings calls, we use a classical accounting textbook, newspaper articles from non-political sections, or transcripts of speeches on non-political topics) to identify two-word combinations (“bigrams”) that are frequently used in political texts. We then count the number of instances in which conference-call participants use these bigrams in conjunction with synonyms for “risk” or “uncertainty,” and divide by the total length of the conference call.

… a dip in revenues during q related to the uncertainty of government approval for the phase funding of the cdc contract additionally …

(Nanogen, Inc)

Next to an extensive audit study, we conduct a battery of tests to show that our measure, which we dub PRisk, indeed reflects meaningful firm-level variation in exposure to political risk. For example, we find that PRisk correlates strongly with firms’ stock price volatility and with managerial actions—including hiring, investment, lobbying, and donations to politicians—in a way that is highly indicative of political risk. These results continue to hold after controlling for news about the mean (as opposed to the variance) of political shocks.

… anticipated such risks and uncertainties include a dependence on economic and political conditions in Israel the impact of competition supply constraints as …

(Pointer Telocation, Ltd.)

One key take-away from our study is that the incidence of political risk across firms is far more heterogeneous and volatile than previously thought: the vast majority of the variation in PRisk is at the firm level rather than at the aggregate or sector level. Suggesting that, when considering exposure to political risk, managers may well be more concerned with their relative position in the cross-sectional distribution of political risk (e.g., drawing regulators’ attention to their firms’ activities) than about time-series variation in aggregate political risk.

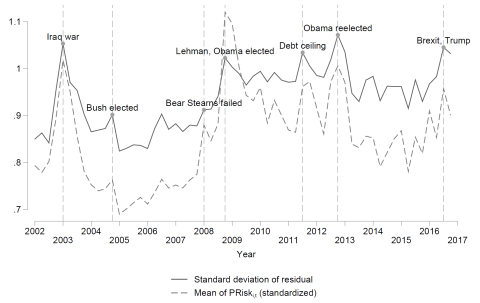

This implies that the effectiveness of political decision-making may have important macroeconomic effects, not only by affecting aggregate political risk, but also by altering the identity of firms affected by political risk and the dispersion of political risk across firms. As shown in the figure below, the dispersion of PRisk increases significantly at times with high aggregate political risk.

After decomposing our measure of firm-level political risk by topic (e.g., “economic policy & budget,” “trade,” “tax policy”), we find that firms that devote more time to discussing risks associated with a given political topic tend to increase lobbying on that topic, but not on other topics, in the following quarter.

We plan to update the data on a quarterly basis and make it available on our website: www.firmlevelrisk.com. We recently took our PRisk measure up to 2019-Q2 for U.S. based and international firms hosting English-language earnings calls.

Academic profile: prof. dr. Stephan Hollander

Reference:

Tarek A. Hassan, Stephan Hollander, Laurence van Lent, and Ahmed Tahoun (2019). Firm-Level Political Risk: Measurement and Effects, The Quarterly Journal of Economics 134(4), pp. 2135-2202.