The procyclicality of banking in the euro area

A high procyclicality of banks’ loan loss provisioning is undesirable from a financial stability perspective, as it implies that bank capitalisations are more negatively affected at the trough of the business cycle, exactly when capital market conditions for banks are at their weakest.

-

prof. dr. Harry Huizinga

Full Professor

TiSEM: Tilburg School of Economics and Management

View full profile

TiSEM: Department of EconomicsH.P.Huizinga@tilburguniversity.edu Room K 354

Luc Laeven

Director-General of the Directorate General Research, European Central Bank and CEPR Research Fellow

This column finds that provisioning procyclicality in the euro area is about twice as high as in other countries. This has important implications for the supervision of euro area banks going forward.

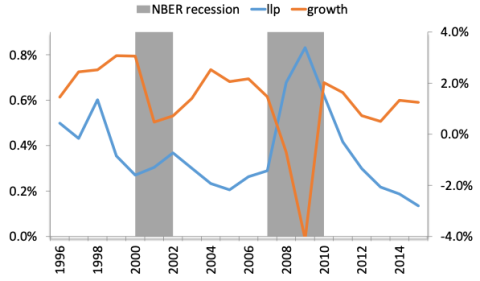

Banks set aside loan loss provisions in anticipation of future loan losses. Loan loss provisions enter the bank’s income statement as expenses, and hence reduce bank profits and bank capital. As banks are subject to minimum capital requirements, additional loan loss provisions can constrain a bank’s capacity to make new loans. Several studies have shown that loan loss provisions are lower at times of high economic growth, and vice versa. This makes loan loss provisions procyclical. Bikker and Metzemakers (2005), for instance, show that loan loss provisions were procyclical in OECD countries during the period 1991–2001.[1] Figure 1 illustrates the procyclicality of loan loss provisions using data for European countries and several non-European OECD countries over the 1996-2015 period. The figure displays a clear negative correlation between average loans loss provisions (relative to bank assets) and the rate of economic growth.

Figure 1 Loan loss provisions and economic growth

Notes: “llp” denotes the ratio of loan loss provisioning to lagged total assets; “growth” denotes real per capita GDP growth; NBER recession denotes recession years according to the NBER. “llp” and “growth” are aggregated values across banks in the full sample of countries used for the analysis in Huizinga and Laeven (2019).

Source: Huizinga and Laeven (2019).

A high procyclicality of banks’ loan loss provisioning is undesirable from a financial stability perspective, as it implies that bank capitalisations are more negatively affected at the trough of the business cycle, which is exactly when capital market conditions for banks are at their weakest. In addition, the procyclicality of loan loss provisions can be a driver of a cyclical bank loan supply, as lower bank equity during economic downturns can lead to a credit crunch (Bernanke and Lown 1991).

In a new paper (Laeven and Huizinga 2019), we examine the procyclicality of loan loss provision for banks internationally. A main finding is that loan loss provisions in the euro area are more procyclical than in non-euro countries. In addition, there is considerable heterogeneity in the procyclicality of loan loss provisioning among euro area banks, which should be a concern for bank supervisors. Recent accounting reform towards an expected loss model of loan loss provisions, in the form of International Financial Reporting Standard (IFRS) 9, by itself is unlikely to eliminate this heterogeneity.

Loan loss provisioning procyclicality in the euro area

For euro area banks, loan loss provisions are a major non-interest expense, amounting to 41% of earnings before provisions. We find that loan loss provisions are procyclical: loan loss provisions (relative to assets) are negatively related to the rate of GDP growth. The estimated effect of GDP growth on loan loss provisioning is material, as a one standard deviation increase in GDP growth is associated with a decrease in provisions that is equivalent to 18% of its standard deviation.

We find that provisioning procyclicality – the impact of GDP growth on provisioning – in the euro area is about twice as high as in other countries. The higher provisioning procyclicality in the euro area is partly caused by an already higher loan loss procyclicality of euro area banks before their respective countries of location adopted the euro. In addition, the higher provisioning procyclicality in the euro area reflects the more negative growth experience of euro area countries during the global financial crisis, as the relation between GDP growth and provisioning is stronger during economic downturns.

Among euro area banks, there is considerable heterogeneity in provisioning procyclicality. In particular, provisioning is more procyclical at bigger banks, which could reflect that bigger banks are willing to take on more business-cycle related risks to their capitalisation due to their too-big-to-fail status. Similarly, banks that are directly supervised by ECB, which tend to be larger, display more procyclical provisioning patterns. Furthermore, provisioning is more procyclical at better capitalised banks, which could reflect that better capitalised banks can better sustain the risks to capital inherent in provisioning procyclicality. Consistent with this, provisioning is more procyclical in countries with more stringent capital regulations.

Loan loss provisioning is the main driver of the cyclicality of bank capitalisation in the euro area, as the sensitivity of provisioning to GDP growth in the euro area can explain about two-thirds of the variation of bank capitalisation over the business cycle. Thus, the cyclicality of loan loss provisioning is likely to be a main determinant of the cyclicality of credit as well. Consistent with this, we find that loan growth is positively related to bank capitalisation. In addition, we show that banks with more procyclical provisioning also display more procyclical lending over the business cycle.

IFRS 9 and loan loss provisioning procyclicality

Accounting standard setters have long prescribed an incurred loss model of loan loss provisioning, which requires banks to record loan loss provisions based solely on information that a loan loss is probable at the measurement date. On 1 January 2018, however, the EU moved from the incurred loss model of provisioning to an expected loss model, with the implementation of IFRS 9 on Financial Instruments. The expected credit loss model of IFRS 9 requires banks to set credit impairment allowances for all loans rather than just for loans where loss is probable or has already occurred. The broader application of the expected loss model to all loans should lead to an increase in the average level of allowances. In line with this, the European Banking Authority (2018) reports that the immediate impact of IFRS 9 has been higher allowances, implying a reduction in the Common Equity Tier 1 (CET1) ratio by 47 basis points on average for a sample of 38 large European banks.

The new accounting rules under IFRS 9 require banks to take material provisions also during economic expansions, in the absence of significant credit impairment. These provisions should reflect the probability of a business cycle turn, which could induce greater credit losses later on. More provisioning in anticipation of the next economic downturn implies that banks have higher accumulated loan loss allowances – loan loss reserves – once a downturn occurs, and that they need to take fewer provisions during economic declines. The introduction of IFRS 9 thus could mitigate the negative relationship between provisioning and economic growth, with a potentially positive effect on financial stability (European Systemic Risk Board 2017).

However, some have argued that the impact of IFRS 9 on the procyclicality of loan loss provisioning is ambiguous. Provisioning for a next economic downturn under the expected credit loss model may be rather abrupt, if an initial turning point in the business cycle is taken to forebode a serious business cycle downturn, triggering large loan loss provisioning in anticipation of future loan impairment. The introduction of the expected credit loss model thus could lead to a concentration of loan loss allowances at the time of an initial economic downturn, with possible negative ramifications for financial stability. Simulations by Abad and Suarez (2017) confirm this by showing that IFRS 9 will concentrate the impact of loan loss allowances on profitability and the CET1 ratio at the beginning of the economic cycle, yielding that banks will face a higher yearly probability of having to be recapitalised.

Conclusions

Our evidence on loan loss provisioning has important implications for the supervision of euro area banks going forward. First, the relatively large provisioning cyclicality in the euro area stresses the need to make efforts to reduce this procyclicality, given that this is likely to remain a problem after the introduction of IFRS 9. Second, the considerable heterogeneity in provisioning among euro area banks could reflect that banks apply the accounting rules regarding provisioning unevenly, which should be a concern for bank supervisors. This heterogeneity is also likely to persist under IFRS 9, and hence supervisors will need to apply efforts to make the application of loan loss provisioning rules across euro area banks more uniform. More generally, our findings call for increased attention to potential undesirable consequences of provisioning rules for the procyclicality of lending.

Authors’ note: The views expressed here are our own and do not reflect those of the ECB or Eurosystem.

References

Abad, J and J Suarez (2017), “Assessing the cyclical implications of IFRS 9 – a recursive model”, ESRB Occasional Paper Series No 12.

Bernanke, B and C Lown (1991), “The credit crunch”, Brookings Papers on Economic Activity 2: 205–247.

Bikker, J and P Metzemakers (2005), “Bank provisioning behavior and procyclicality", International Financial Markets, Institutions and Money 15: 141–157.

Bouvatier, V and L Lepetit (2012), “Provisioning rules and bank lending: A theoretical model”, Journal of Financial Stability 8, 25–31.

European Banking Authority (2018), “First observations on the impact and implementation of IFRS 9 by EU institutions”.

European Systemic Risk Board (2017), “Financial stability implications of IFRS 9”.

Laeven, L and H Huizinga (2019), “The procyclicality of banking: Evidence from the euro area”, CEPR Discussion Paper 13605.

Laeven, L and G Majnoni (2003), “Loan loss provisioning and economic slowdowns: too much, too late?”, Journal of Financial Intermediation 12: 178–197.

Olszak, M, M Pipien, I Kowalska and S Roszkowska (2017), “What drives heterogeneity of cyclicality of loan-loss provisions in the EU?”, Journal of Financial Services Research 51: 55-96.

Endnotes

[1] See also Laeven and Majnoni (2003) andOlszak et al. (2017).