Value and Momentum from the Perspective of Financial Professionals

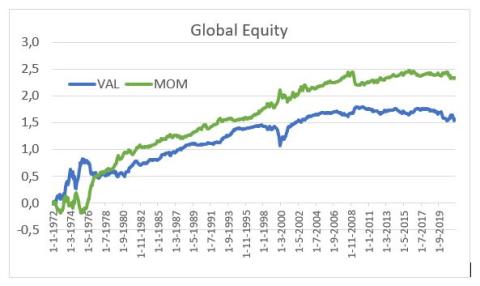

Value and momentum remain among the most popular investment styles of professional investors and fund managers. Historically, these strategies have performed very well, even despite temporary setbacks. But does this higher performance also imply that value and momentum strategies are associated with increased risk?

-

dr. Christoph Sextroh

Associate Professor

TiSEM: Tilburg School of Economics and Management

View full profile

TiSEM: Department AccountancyC.J.Sextroh@tilburguniversity.edu Room K 249

Traditional financial theory assumes that higher returns do not come without higher risk. However, despite a considerable number of theoretical models and empirical tests there is still considerable debate concerning the link between value, momentum, and risk.

|

The portfolios are an updated and extended version of factors in Asness, Clifford S., Tobias J. Moskowitz, and |

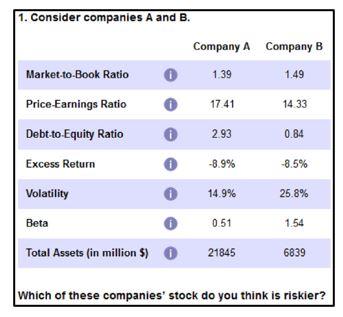

We approached this uestion from a more direct perspective and invited finance professionals from the CFA Institute and the Society of Investment Professionnals in Germany (DVFA) to participate in an online experiment that elicits how the risk assessments related to various key financial and performance figures. These include the market-to-book ratio and the P/E ratio as measures of value, as well as the excess return relative to the market over the last twelve months as a measure of momentum. Based on these figures, participants were then asked to compare two randomly selected companies and assess which of the two company shares they consider riskier (see figure below). For some of the company pairs we also asked about expected returns, as not all participants may have the historical returns of value and momentum investment styles in mind or believe that historical perfirmance will continue in the future.

Our results indicate that professional financial market participants see both value and momentum stocks as less – not more - risky. For one, participants are skeptical when they observe a high market valuation, expressed in a higher P/E ratio or a higher market-to-book ratio. One explanation may be that participants consider it uncertain whether a higher valuation is justified and thus associate higher risk with value stocks. For another, high past returns do not seem to scare investors. Rather, it is companies with negative return trends that are seen as riskier. These patterns are surprising, especially considering that participants interpret traditional risk measures, such as volatility and beta, as risky. As such, our results for value and momentum are embedded in a risk assessment that is otherwise in line with traditional financial theory.

Do these findings imply that there are there relatively safe stocks with strong returns that can easily be identified based on simple ratios? Convinced value and momentum investors will claim just that. However, this opinion cannot be mainstream, otherwise all investors would flock to this segment, driving prices up. We therefore also analyzed participants’ return expectations. Interestingly, participants expect positive returns over the last twelve months to continue at least over the next twelve months. Momentum therefore promises high returns with modest risk from the perspective of financial professionals. The results for value are somewhat more mixed. Shares with a low P/E ratio are seen as likely to outperform in the future, but this does not apply to shares with a low market-to-book ratio.

Taken together, the impression of professional investors seems to be that value and momentum are not risk factors but anomalies. Consistent with this interpretation, we also find that the efficient market theory does not rank very highly among the participants when asked which financial market models they consider valid. Factor models and valuation based on multiples enjoy a much higher reputation.

Source: Based on “Value and momentum from investors’ perspective: Evidence from professionals’ risk-ratings” by Christoph Merkle and Christoph Sextroh, published in: Journal of Empirical Finance, 62, 2021, p. 159–178.

Read the article.